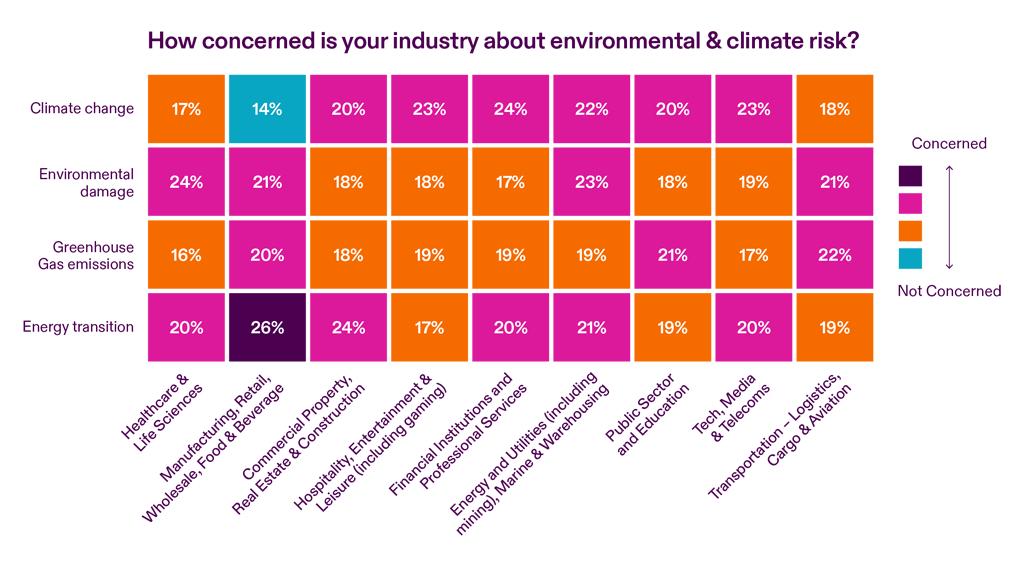

As the events of the past year have shown us, extreme weather events bring with them a host of risks. Firms that fail to plan for environmental and climate risks are leaving their business unprepared and exposed to multifaceted risks.

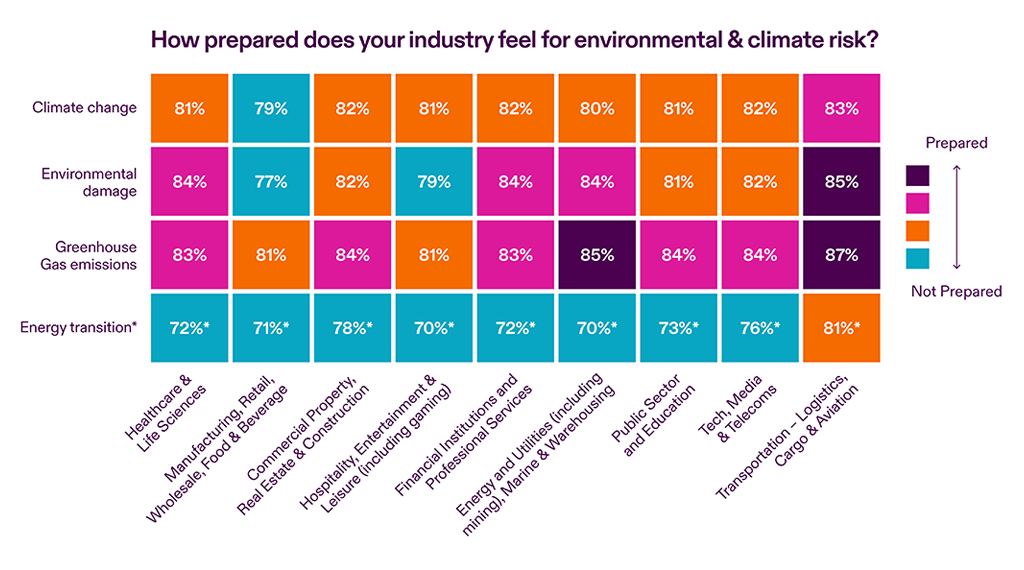

Despite good intentions, 73% of global executives surveyed agree economic uncertainty is diverting their attention away from their sustainability goals by making it less of a priority and 67% are finding it hard to transition to non-carbon energy and meet net zero targets.

Additionally, international agreement on climate action is fraying at the edges, increasing the fragmentation of the regulatory landscape.