There is a growing divergence in the approach to Environmental, Social, and Governance (ESG) regulations and principles between economic blocs. As recent developments in the US have shown, the move towards more stringent environmental regulations is by no means universal. This divergence can be particularly problematic for Private Equity (PE) firms and their investment businesses looking to comply with ESG regulations in multiple jurisdictions.

Convergence and Divergence

This year, a raft of new environmental-related regulations is set to come into force for certain businesses, imposing stricter reporting requirements and, in some cases, compelling businesses to restructure their operations to comply. These new regulations create significant uncertainty for multinational firms, primarily due to growing divergence between jurisdictions.

Our latest Risk & Resilience research data1 reflects this challenge, with almost a fifth (19%) of global executives citing ESG risk and the failure to comply with new ESG requirements, including related legislation, regulation, or reporting requirements, as their top concern this year. Additionally, 73% of global executives admit that they are less focused on their sustainability and ESG goals due to the current challenging economic climate. Among Financial Institutions and Professional Services companies surveyed, 26% rank failure to comply with ESG regulatory requirements as their top risk, 22% rank energy transition as a major concern, and 36% are worried about climate risk, significantly higher than the global respondent average of 20%.

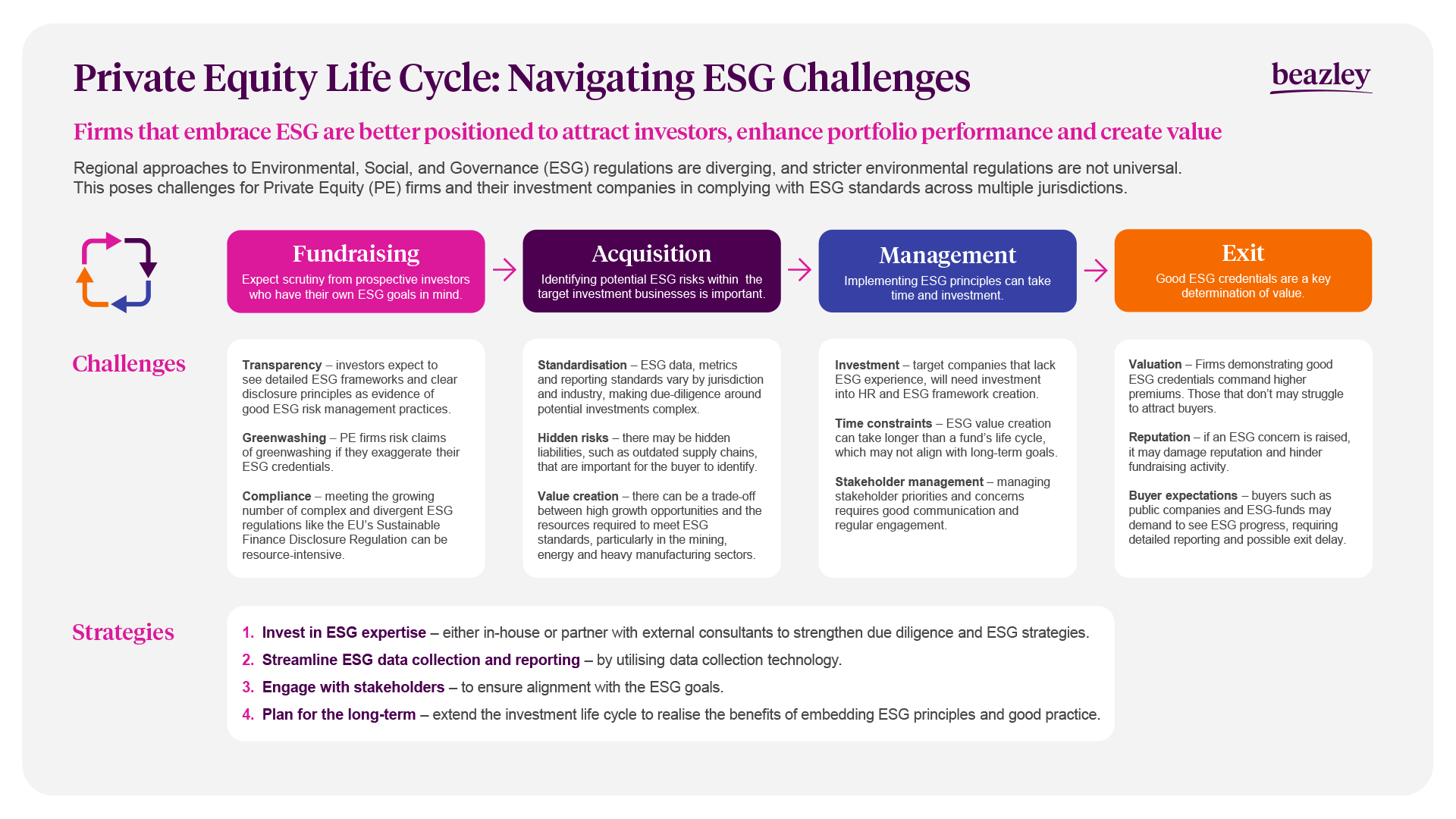

With this information in mind, let's explore some of the specific challenges faced at each stage of the PE investment life cycle.

-

Chloe Cox

Underwriter - International Management Liability

1- Beazley 2025/26 Risk & Resilience Research