Our focus is on greater transparency of our approach to responsible business. In this section you’ll find information about our Sustainability strategy, policies and procedures and be able to download relevant documents.

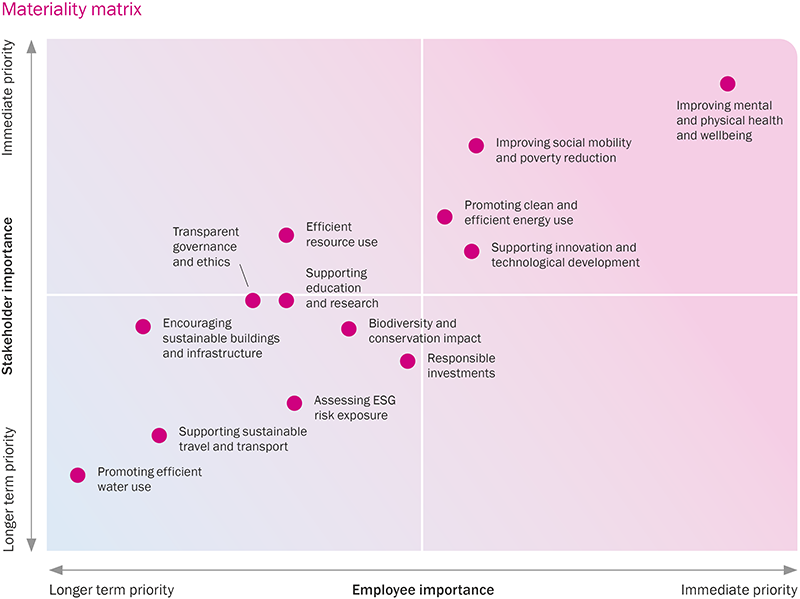

Our 2020 Responsible Business Strategy surveyed internal and external stakeholders to understand the material issues and how we should prioritise them. From a large initial list of 65 topics, supporting the UN Sustainable Development Goals (SDGs), we grouped them into 17 material issues which with further dialogue with employees and external stakeholders we ranked as shown in our materiality matrix.

Four issues that we consider integral to our business strategy were not part of the survey. These are:

The 17 were then grouped under 4 key core elements that make up our responsible business ambitions;

As a specialist insurer, many of our products support the the 17 UN SDGs. Our healthcare products support institutions and companies contributing to SDG 3 – Good Health and Wellbeing. Our property products help support delivery of SDG 11 – Sustainable Cities and Communities. And our environmental products support delivery of SDG 15 – Life on Land.

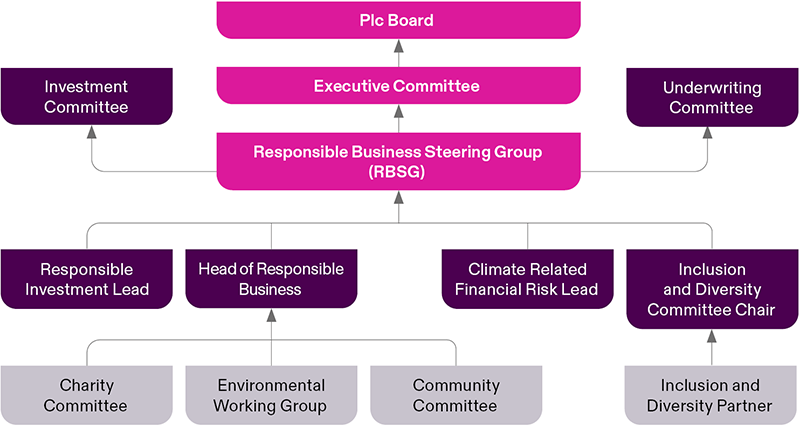

Delivery of responsible business lies with the plc Board and Executive Committee, these bodies are assisted by the Responsible Business Steering Group, which provides recommendations for action on ESG issues to Beazley’s Underwriting and Executive committees.

The Responsible Business Steering Group (RBSG), is chaired by the CEO, attended by the CRO and CUO, and senior representatives from across the business. The RBSG meets monthly to receive updates on progress against our Responsible Business objectives. Quarterly, directors from the Beazley Boards including Non-Executive Directors of Beazley plc also attend RBSG.

More details of our climate risk reporting is detailed within our TCFD report.

Underpinning responsible business is our Environmental Management System (EMS), which has been designed in accordance with ISO14001:2015. We use EMS as the framework and governance process to ensure our approach to responsible business supports the wider business strategy.

We operate a group-wide compliance framework designed to measure risk exposure, govern decision-making and monitor performance. Our framework includes the following systems and controls:

Beazley’s executive management is responsible for the operation of our compliance framework and there is top down commitment to good conduct and regulatory compliance. The risk team's monitoring reviews provide assurance on the performance of systems and controls. Through regular reporting of our monitoring activities, we ensure that senior management maintain oversight of regulatory risk across the group.

Knowing our clients and business partners is central to managing risk and ensuring we only transact with reputable intermediaries, agents and suppliers and we have policies, procedures and controls embedded in the business to ensure compliance.

We adhere to all applicable financial and trade sanctions. We closely monitor sanctions developments and are primed to respond when changes occur and to ensure compliance, we have embedded sanctions due diligence procedures into our underwriting and claims processes and ensure continued understanding of sanctions developments through staff training. We work closely with partners to ensure our approach to financial and trade sanctions is reflected in business relationships, achieved through extensive due diligence and communication of our expectations.

A strong belief in ethical business practices underpins our relationships with customers and business partners. We operate within strict guidelines that govern the payment of commissions, the exchange of gifts and entertainment, and all circumstances capable of leading to a conflict of interest. In particular, we maintain a number of policies and procedures to ensure compliance with anti-bribery laws.

The exchange of gifts and hospitality is closely monitored to ensure that business decisions are free from improper influence. Where there is a risk of potential impropriety, staff are able to make use of various avenues for reporting instances of attempted bribery, corruption or conflicts of interest.

Beazley takes its responsibility around anti-money laundering seriously, Controls include transaction monitoring and ascertaining the identity of our counterparties and any instance of suspicious activity is acted on in accordance with our group-wide financial crime policy.

Conduct is a core aspect of our business. It permeates our culture and informs how we design, market and service our products. We ensure the application of good conduct principles by:

We have a robust approach to information security and privacy comprising organisational, human and technical controls designed to safeguard data and the rights of data subjects.

To ensure consistent compliance with data requirements, we undertake frequent security testing and annual data security/privacy audits.

Our governance structure enables the information security and privacy function to escalate and report data-related matters without restraint, thereby ensuring senior management oversight of data risk management at all times. We are committed to upholding the rights of data subjects, informing them of the information we collect and process, and ensuring that we only collect what is required to deliver our services.

We observe the legal and regulatory requirements of the various jurisdictions in which we operate and have a global privacy policy aligned to European, North American, Canadian and Singaporean privacy requirements. In all, our information security and privacy programme is built around a framework of prepare, protect, detect, respond and recover. This enables us to take precautions, act decisively and protect the interests of our data subjects. There have been no cases of a data breach that has had a material impact on our clients or our business, nor one that has necessitated any need to report the matter to our clients or any of our regulators.

In line with our values, we actively promote a culture that encourages staff to speak up and escalate concerns. Our whistleblowing policy allows for anonymous reporting of concerns without fear of reprisal, harassment, retaliation or victimisation. Such reports are treated with the utmost confidentiality and in accordance with all applicable legal and regulatory requirements. Annual reports are presented to the Boards of Beazley Furlonge Ltd and Beazley Insurance Designated Activity Company (BIDAC), as well as the Plc Audit and Risk Committee on the effectiveness and operation of our whistleblowing procedures. Over the past 12 months there have been no whistleblowing cases.