Article

Unlocking climate infrastructure at scale in Malaysia

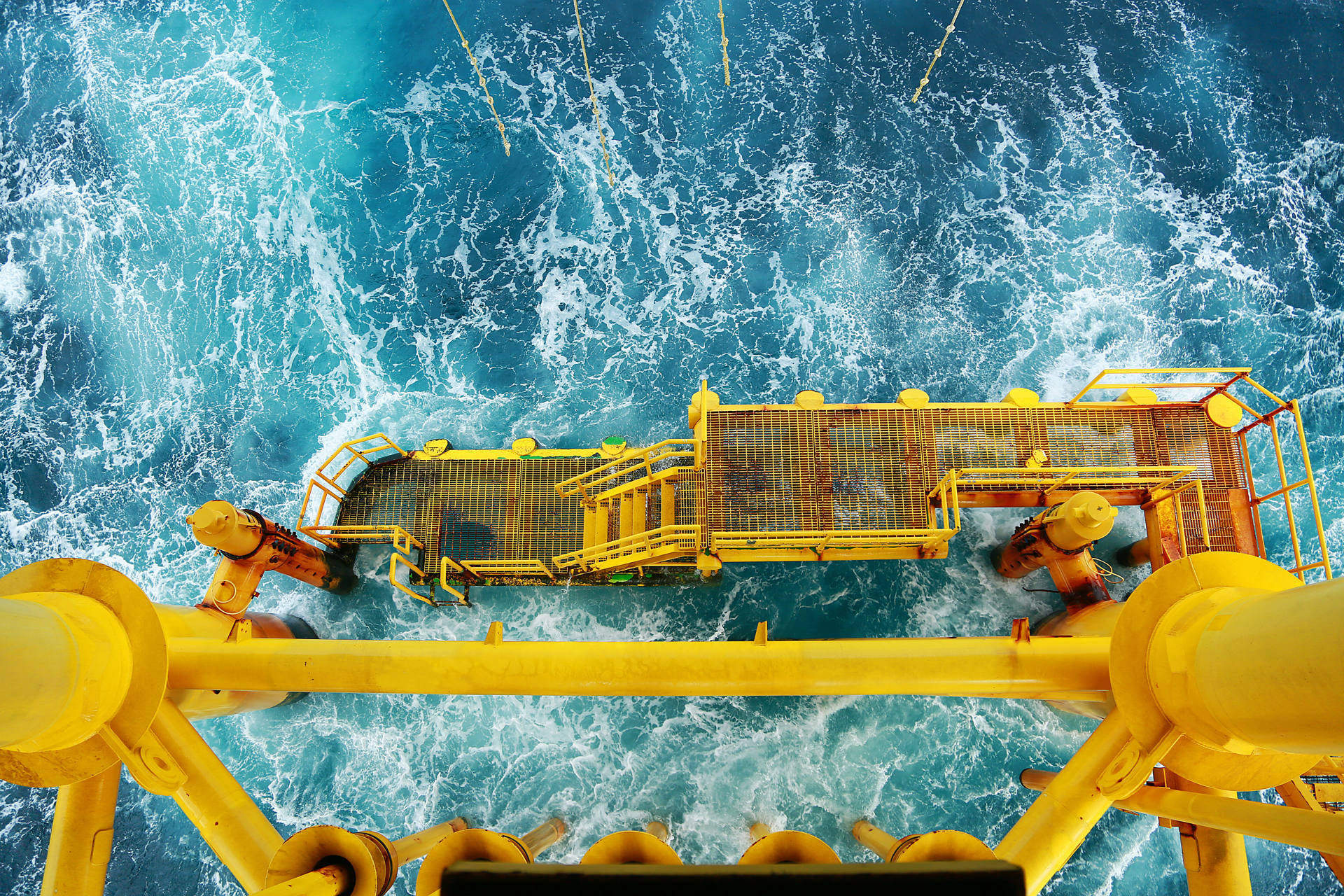

Big ambition, deep water, and a lot of carbon. With Malaysia on the race to net zero, Beazley’s cover helped make this offshore CCS project possible.

Exploring the problem

When Malaysia began its industrial ascent in the 1970s, few could have predicted how quickly it would become one of Southeast Asia’s most dynamic economies. In just a few decades, the country built a thriving manufacturing base, expanded its energy sector, and positioned itself as a regional hub for trade and investment. But with that growth came a familiar consequence: rising emissions.

By the early 2000s, Malaysia’s power plants, refineries, and industrial complexes were emitting millions of tonnes of carbon dioxide each year. The government – recognising the long-term risks – committed to achieving Net Zero Carbon Emissions by 2050. But the path to decarbonisation was never going to be straightforward. Malaysia’s economy is energy-intensive, and many of its emissions come from sectors that are difficult to abate.

That’s where carbon capture and storage (CCS) entered the picture. Drawing on its deep oil and gas expertise, Malaysia began exploring offshore storage and carbon management technologies. The goal was clear: reduce emissions without derailing industrial growth. But CCS projects are complex, expensive and fraught with risk. And without the right financial structures in place, many would never get off the ground.

Creating a solution

In April 2023, Beazley began underwriting a first-of-its-kind offshore carbon capture sequestration project off the coast of East Malaysia. The risks were significant: infrastructure development, supply chain disruption, long-term storage integrity, and regulatory compliance – each one a potential deal-breaker that could derail progress, inflate costs, or trigger cascading failures if not rigorously addressed.

Beazley’s role was to make those risks manageable, transforming potential roadblocks into strategic advantages. This project marked a key milestone for the region and contributed to strengthening the Southeast Asian country’s position in green technology innovation.

In all, we provide tailored coverage prior to injection, allowing developers to secure the necessary investments and financing needed to move forward. The policy includes liability protection for potential leaks and unforeseen disruptions – issues that could otherwise stall progress or deter capital.

This wasn’t a theoretical exercise. It was a live project, backed by real capital, and it marked a turning point in how insurance supports the energy transition. Not by reacting to loss, but by enabling innovation.

Building long-term resilience

The project is expected to reduce carbon emissions by 3.3 million tonnes per year, making it one of the largest offshore CCS initiatives in the world. But its impact goes beyond the numbers. It sets a precedent for future CCS schemes, particularly in sectors covering like power plants and industrial complexes, where emissions are hardest to eliminate.

For Malaysia, the project is a strategic asset. It strengthens the country’s position as a regional leader in green technology and provides a blueprint for and facilitating its progress in achieving Net Zero Carbon Emission targets (NZCE) by 2050.

For the insurance sector, it’s a clear signal of what’s possible. Strategic cover can not only enable large-scale climate infrastructure, but also unlock new commercial opportunities by making emerging technologies bankable, investable and scalable.

The information set forth in this communication is intended as general risk management information. Beazley does not render legal services or advice. Nothing in this communication should be construed or relied upon as legal advice or used as a substitute for consultation with counsel. Although reasonable care has been taken in preparing the information set forth in this communication, Beazley accepts no responsibility for any errors it may contain or for any losses allegedly attributable to this information.