Responsible Investment Policy

We believe that we will enjoy competitive advantages over time if we have a sustainable approach to investment which we set out in our Responsible Investment Policy.

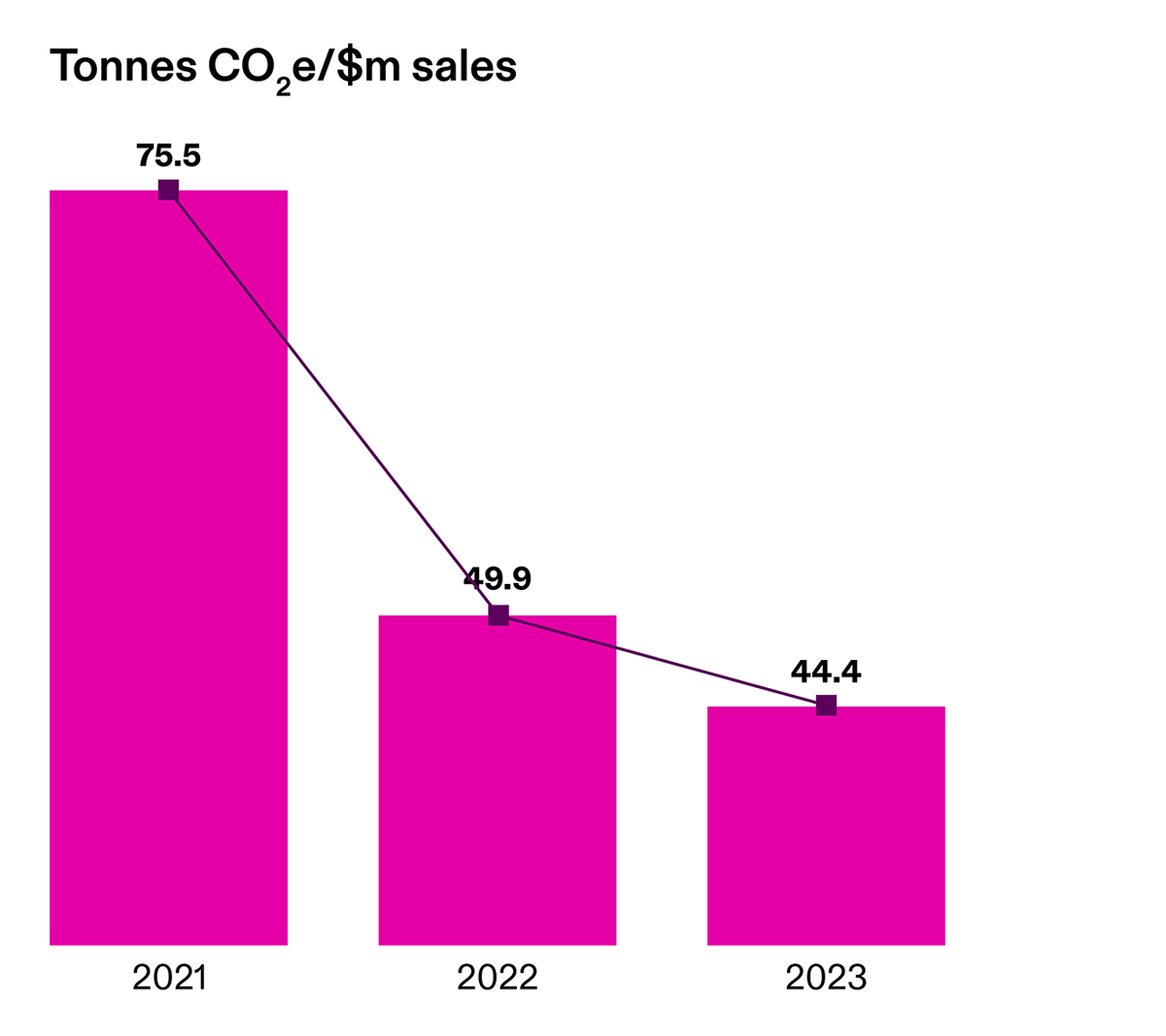

We use a number of key metrics to measure the climate-related impacts of our investment portfolio. Looking at the Weighted Average Carbon Intensity (WACI) of our corporate bonds and equity portfolios, you can see this has reduced significantly in the last three years:

WACI is based on reporting of GHG emissions on an Enterprise Value including Cash (EVIC) basis. The scope of reporting is limited to the GHG emissions arising from our publicly listed corporate bonds (investment grade and high yield) and publicly listed equities. Emissions have been reported for 97.6% of the market value of in scope assets.