Market-leading coverages that add a valuable layer of financial protection.

When a cyber incident hits, the costs can quickly spiral. Our Full Spectrum Cyber solution incorporates market-leading coverages that add a valuable layer of financial protection and mitigate potential losses against digital risks.

Designed to help get businesses back up and running as soon as possible when they’ve suffered a cyber incident, these 4 pillars of coverages are available for our small, medium and large sized cyber clients:

Breach Response | First party | Third Party | eCrime

Breach response costs:

Coverages for expenses of breach response services due to an actual or suspected data or security breach.

First-party:

These coverages offer financial protection against the direct costs associated with a cyber incident, breach or system failure.

Third-party:

These coverages protect against claims made by customers, partners, or other third parties that are affected by a cyber incident.

eCrime:

These coverages protect against direct financial loss of funds due to fraudulent instruction or funds transfer fraud.

Cyber risk insurance varies widely in what's included. Some policies cover only specific types of cyber events and may include sub-limits for certain incidents.

What makes our policy different

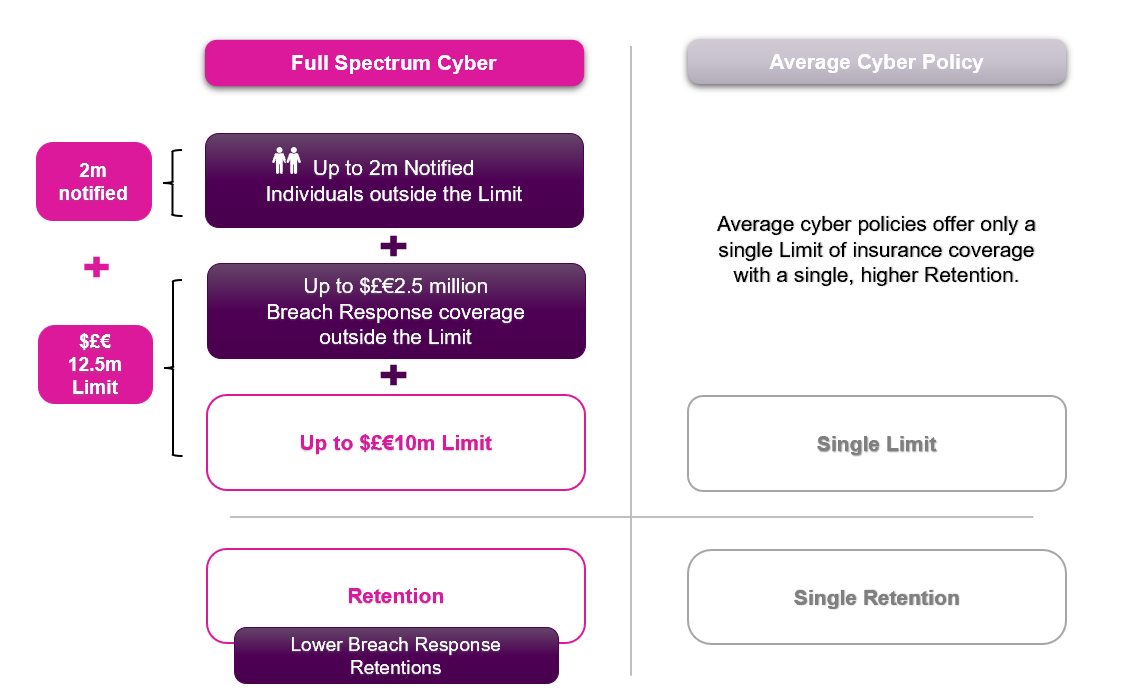

Full Spectrum Cyber incorporates our flagship, Beazley Breach Response (BBR) wordings. Here’s how it compares to the average cyber policy. Clients need more than the main aggregate to get back in the game after a cyber incident; our product offers more coverage per dollar of premium through multiple towers of coverage.

Full Spectrum Cyber not only provides financial protection against cyber risks, but also offers direct access to cyber security expertise with Beazley Security’s pre and post incident response services. It’s this unique ecosystem that focuses as much on keeping our clients one step ahead of the cyber risks as it does getting them back into business quickly should the worst happen.